Introduction

Economic indicators serve as vital tools for analyzing the health and direction of a nation’s economy. Among these, two essential components often studied by economists and policy makers are business inventories and gross private domestic investment (GPDI). While each plays a unique role in measuring economic performance, their interplay offers critical insights into production trends, consumer demand, and overall economic momentum.

This comprehensive article explores the definitions, interrelationships, economic implications, and policy considerations surrounding business inventories and GPDI. It also examines real-world examples and historical data to provide a deeper understanding of how these variables influence the broader economy.

1. Defining Business Inventories

Business inventories refer to the stock of goods that businesses hold at any given time. These inventories include raw materials, work-in-progress goods, and finished products ready for sale. Inventories are maintained by manufacturers, wholesalers, and retailers and represent a buffer between production and consumption.

Business inventories are a crucial component of the GDP calculation and are categorized under investment, specifically as part of GPDI. Changes in inventories signal shifts in demand and supply dynamics. An increase in inventories may indicate that production has outpaced demand, while a decrease might suggest strong consumer demand or production slowdowns.

2. Understanding Gross Private Domestic Investment (GPDI)

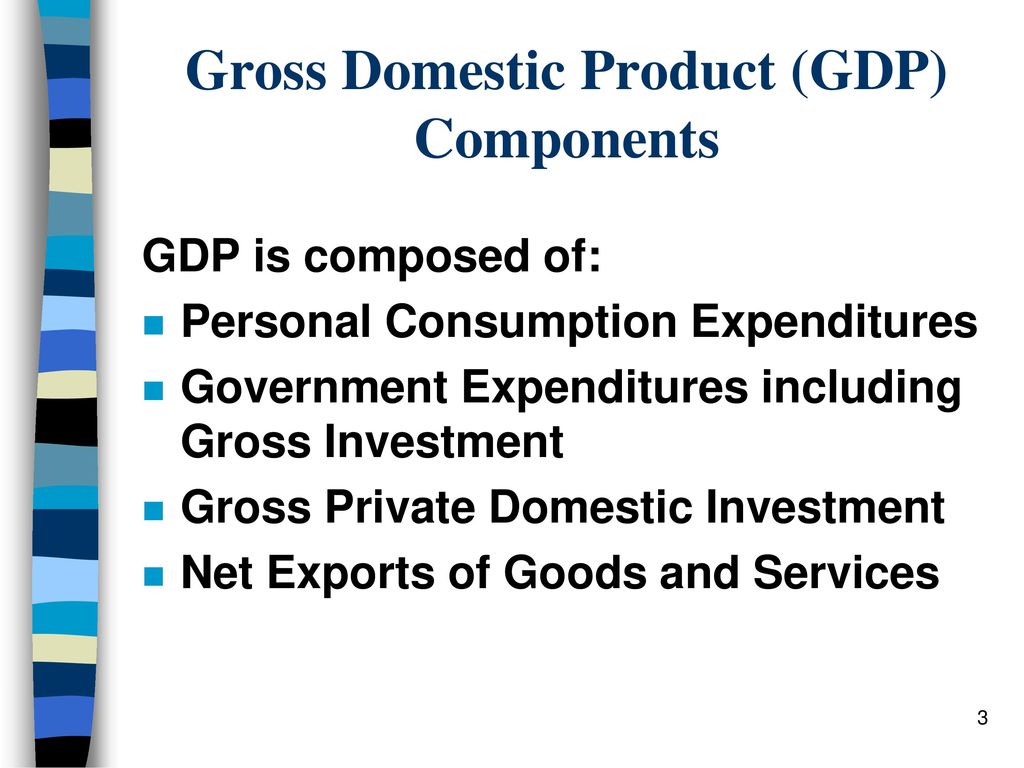

Gross Private Domestic Investment is a critical GDP component that captures the total investment in capital goods by private sector businesses and households. GPDI includes:

- Non-residential investment (e.g., structures, equipment, and intellectual property)

- Residential investment (e.g., construction of new homes and residential structures)

- Changes in private inventories

GPDI reflects how much businesses are spending on expanding their productive capacity, which directly influences future economic growth.

3. The Relationship Between Inventories and GPDI

Inventories are a subset of GPDI. Fluctuations in inventory levels directly impact the total investment figures in a given period. If businesses build up inventories, GPDI increases, contributing positively to GDP. Conversely, inventory drawdowns subtract from GPDI and GDP.

This relationship is critical for understanding short-term economic fluctuations. For example, during economic expansions, companies may increase production and accumulate inventories in anticipation of rising demand. In contrast, during downturns, businesses may cut back on production and deplete existing inventories.

4. Measuring Business Inventories and GPDI

Data on business inventories and GPDI are collected and published by national statistical agencies, such as the U.S. Bureau of Economic Analysis (BEA) and U.S. Census Bureau. Key reports include:

- Monthly Wholesale Trade Report

- Manufacturing and Trade Inventories and Sales (MTIS)

- GDP quarterly estimates

These reports offer insights into inventory levels across various sectors and help identify economic trends.

5. Economic Implications of Inventory Changes

Changes in inventories have wide-ranging implications for the economy:

- Indicator of demand: Rising inventories may suggest weakening consumer demand, prompting businesses to scale back production.

- Production planning: Inventory levels influence firms’ decisions on production schedules, labor needs, and investment in new facilities.

- Price stability: Excessive inventories may lead to price discounts, while shortages can drive up prices, affecting inflation.

- Supply chain health: Inventories reveal how well supply chains are functioning and whether bottlenecks are emerging.

6. Historical Examples and Trends

Throughout economic history, inventory trends have mirrored business cycles:

- 2008 Financial Crisis: Inventories plummeted as demand collapsed, contributing to the sharp GDP decline.

- COVID-19 Pandemic (2020): Disruptions to global supply chains led to unprecedented inventory shortages in key industries, including semiconductors and consumer electronics.

- Post-Pandemic Recovery: In 2021 and 2022, many businesses aggressively rebuilt inventories to meet pent-up demand, driving up GPDI.

7. Business Inventories in Different Sectors

Inventories differ in importance and behavior across economic sectors:

- Manufacturing: Holds large volumes of raw materials and finished goods; highly sensitive to global supply chain dynamics.

- Wholesale: Acts as a distribution bridge between manufacturers and retailers; inventory management is critical to pricing and supply.

- Retail: Fast-moving inventories influenced by consumer preferences, seasonality, and marketing campaigns.

8. Inventory Management Strategies

Effective inventory management helps businesses balance production and sales:

- Just-in-Time (JIT): Minimizes inventory levels to reduce storage costs but increases vulnerability to supply disruptions.

- Economic Order Quantity (EOQ): Calculates optimal order quantity to minimize total inventory costs.

- ABC Analysis: Categorizes inventory by value and turnover rate to prioritize management efforts.

9. Role of Technology in Inventory and Investment Management

Modern technologies play a crucial role in managing inventories and planning investments:

- Enterprise Resource Planning (ERP) systems integrate inventory data across departments.

- Data analytics improve demand forecasting and inventory optimization.

- AI and machine learning offer predictive insights into market trends and inventory needs.

10. Policy Implications and Fiscal Considerations

Governments monitor inventories and investment to guide economic policy:

- Monetary policy: Central banks may adjust interest rates based on inventory and investment trends to manage inflation and growth.

- Fiscal policy: Government spending and tax incentives may be used to stimulate private investment.

- Trade policy: Tariffs and trade agreements affect inventory sourcing and investment in domestic production.

11. Business Inventories and the GDP Calculation

GDP = C + I + G + (X – M), where:

- C = Consumption

- I = Investment (includes GPDI)

- G = Government spending

- X = Exports

- M = Imports

Inventories are counted in the “I” component. Their change from one period to the next determines their impact on GDP growth.

12. Risks and Challenges in Managing Inventories

Poor inventory management can lead to several risks:

- Overstocking: Ties up capital and increases holding costs.

- Understocking: Leads to stockouts and lost sales.

- Obsolescence: Particularly in tech and fashion sectors where goods quickly lose value.

- Supply chain disruptions: Natural disasters, pandemics, or geopolitical tensions can cause inventory bottlenecks.

13. The Link Between Inventories, GPDI, and Business Confidence

Businesses adjust their inventory levels and investments based on confidence in future economic conditions. High confidence leads to inventory accumulation and capital investments. Low confidence results in cautious spending and production cutbacks.

14. Seasonal Effects and Inventories

Inventory levels often exhibit seasonal patterns:

- Retail: Peaks during holiday seasons and promotional events.

- Agriculture: Influenced by planting and harvest cycles.

- Construction: Affected by weather and project timelines.

Understanding these patterns helps businesses plan more effectively and avoid disruptions.

15. Globalization and Inventory Management

In a globalized economy, inventory strategies must consider:

- International suppliers: Shipping times, currency risks, and political stability.

- Global demand: Trends in emerging markets influence inventory decisions.

- Regulatory compliance: Safety, labeling, and environmental standards vary by region.

Conclusion

Business inventories and gross private domestic investment are foundational pillars of economic analysis. Together, they offer a window into business activity, consumer behavior, and the overall trajectory of the economy. Effective management and interpretation of these indicators empower decision-makers to respond proactively to economic changes.

By understanding the intricacies of inventories and GPDI, businesses can optimize operations, economists can better forecast trends, and policymakers can craft informed strategies to foster sustainable growth. As global markets evolve and technological innovation accelerates, the importance of these metrics will only grow in shaping a resilient economic future.